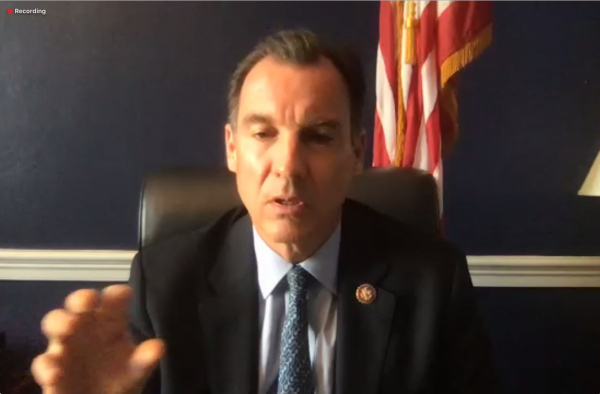

U.S. Rep. Tom Suozzi (D-Glen Cove) said he is standing firm on a demand, along with other lawmakers, to restore the full state and local tax deduction for federal taxpayers.

At a joint news conference on Zoom with Rep. Young Kim (D-California) last Wednesday, Suozzi made clear he would not vote for any tax reform legislation that did not include the lifting of the limit on the deduction, known as SALT.

“We made it clear that if you want to make any changes to the tax code – no SALT, no deal,” Suozzi said. “If you don’t change the SALT deduction, restore it to what it was, you’re not going to have our votes on other changes to the tax code.”

Under legislation signed by then President Donald Trump, the deduction is capped at $10,000. This has the effect of raising federal taxes for homeowners in areas with high property taxes like the North Shore.

Since the early days of the federal income tax, SALT had been a favorite of states and villages who didn’t want an over-extension of the federal government preventing local services, according to Suozzi. Now that it has been limited, the former Nassau County executive said he is among over 100 representatives who have co-sponsored legislation for its reinstatement and formed a bipartisan SALT caucus.

“We don’t want to have our taxpayers have to pay taxes on the taxes they’ve already paid,” Suozzi said.

He said some residents have chosen to leave New York.

“When wealthy people leave our states, leave our cities, leave our counties to go to other places, they take with them the revenues that go into our budgets,” he said. “It makes it much more difficult for our cities and our states and our counties to survive.”

Unpopular decisions follow the loss of tax revenue, according to Suozzi.

Tonight, I and a dozen of my colleagues made our message clear – the cap on the SALT deduction has hurt middle class families and was an intentional attack on high tax states. For months we have been making our voices heard, and we will not stop until the SALT cap is repealed. pic.twitter.com/hzUc3hH9It

— Tom Suozzi (@RepTomSuozzi) June 30, 2021

“Their choices are either to make up those revenues by increasing taxes, which nobody wants, or to decrease services, which certainly doesn’t make sense in the midst of just recovering from the pandemic,” he said.

There is an option to raise the deduction cap, but Suozzi is fighting for a full repeal.

“Raising the cap would be a great political victory but not a policy victory,” Suozzi said. “Whether it’s people who deduct $20,000 or $30,000 or people who deduct $100,000, we don’t want people leaving our states.”

“We just announced this bipartisan deal on infrastructure,” Suozzi said. “There’s more and more momentum of people trying to work together to get the solution.”

The SALT deduction cap of $10,000 has to stay to ensure that residents pay their fair share in federal taxes. The State of New York & towns within and other deep blue governing bodies have taken advantage of the deduct-ability of state & local taxes to massively grow their own governments over the years to expand their control.

The state of New York and it’s towns don’t have a revenue problem they have an expense problem. But cutting expenses is anathema to them they absolutely will never do this until forced which is what the SALT cap ensures.

SALT cap needs to be extended beyond 2025 so these Democrat party politicians are under no illusions that the necessary reforms must be undertaken and there is no way to weasel out of it.

Is is it fair that tax payers pay federal tax on taxes paid to the state and local governments? That is paying tax on tax! No matter what your political persuasion is, this is just ridiculous over-taxation!

Allen Wait to you retire and you have to pay a tax on your social security retirement. That is money you already paid taxes on. See how you like that.

How dare they touch our retirement fixed income. It’s criminal what they want to do