It sure does appear that our market is still moving expeditiously along, although in some areas it’s a bit slower depending on the listing price, type of property, location and school district as well as the negotiability of the sellers today.

There are still some buyers who qualify for a mortgage and are putting down 20% to 30% with 700 credit scores or better and low debt/income ratios, making it easier to qualify for their financing. Then again, there are others purchasing for cash and buying outright without any financing. This appears to be relevant in the states and locations where a majority of purchasers have moved from higher-priced states.

The top 10 states that have had losses in population in 2022 and 2023 (and some over the last 10 years) New York, Illinois, Hawaii, California, Louisiana, Massachusetts, West Virginia, Mississippi, Pennsylvania and Michigan, according to the Census Bureau. New Jersey is 11th on the list.

There are some obvious reasons for population decline in those states. The cost of living and real estate and state taxes were the main cause, especially for those not earning an adequate income. Many have been laid off and more will be let go over the next six to 36 months.

Major corporations like Amazon had doubled the number of employees as the

headcount peaked in 2021 with 1.6 million full-time and part-time employees (excluding

external contractors). However, in 2022, layoffs reduced that number to 1.54 million employees from the start of the pandemic continuing through 2022. Layoffs have continued as an additional 27,000 have been let go.

Sales have drastically retreated in many industries, creating the immediate need to cut expenses, meaning more layoffs. Many hi-tech companies’ sales have been reduced as more individuals have made the decision to work remotely and companies are cutting back their budgets and purchasing less equipment and technology

Layoffs will continue as long as there is pressure on company sales and profits, reflecting the continuing impact that our pandemic has made on a multitude of companies and our economy. As layoffs continue there will be a lag effect in the way that foreclosures and short sales will occur.

For those whose businesses have failed or who have lost their jobs and are currently

homeowners, it would be prudent today to take advantage of the higher prices, plan ahead and consider selling and cashing out, while you have a substantial amount of equity gained over the last few years. This is an opportune time to get out so you can leave with an ample sum of money in your bank account. Why wait until prices moderate lower in the future?

Long Island has seen strength in the market with buyers still out trying to find their next place to call home. However, some buyers have hopped back on the fence to wait it out until rates go lower. This may take a few years based on where inflation and our economy are currently.

Lawrence Yun, economist for the National Association of Realtors’ research, said statistics showed that people living out West, where five out of the 10 most expensive cities are in California, have seen the greatest price reductions. San Jose was the most expensive place to purchase a home in the nation in the fourth quarter of 2022 when the median price was $1.57 million. It is now down 5.8% from a year ago, and prices there have already dropped 17% from the peak of $1.9 million in the second quarter of 2022.

According to N.A.R, San Francisco had the largest price drop in the country, year over year, last quarter, with a median price of $1.23 million, down 6.1%. Homes there were already down 21% in the fourth quarter of 2022 from the peak median price of $1.55 million in the second quarter. Other cities where prices were down are Los Angeles; Boulder, Colo.; Boise, Idaho, and others. Prices have increased in many areas by as much as 42% over the last three years, said Yun, noting that the swelling of prices has far surpassed wage increases and consumer price inflation since 2019.

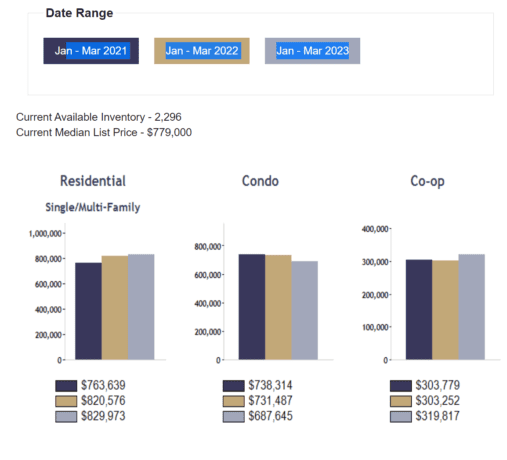

Single and multi-family homes have still increased, although at a much slower pace than in the last two years. However, co-ops have done extremely well and

have increased, I believe, due to the lower price points and they are much more affordable, compared to condos and homes allowing those entering the market to become homeowners.

As you can see, our areas are still doing quite well, even though interest rates have increased, there are cash purchasers still buying and even with the loss of population, demand is still fairly strong. However, no one can predict the future.

Philip A. Raices is the owner/Broker of Turn Key Real Estate at 3 Grace Ave Suite 180 in Great Neck. For a “FREE” 15 minute consultation, value analysis of your home, or to answer any of your questions or

suggestions on future columns with your name, email and cell number and he will call or email you back.