Long Island congressmen from across counties – and party lines – are coming together to fight the current House tax overhaul plan.

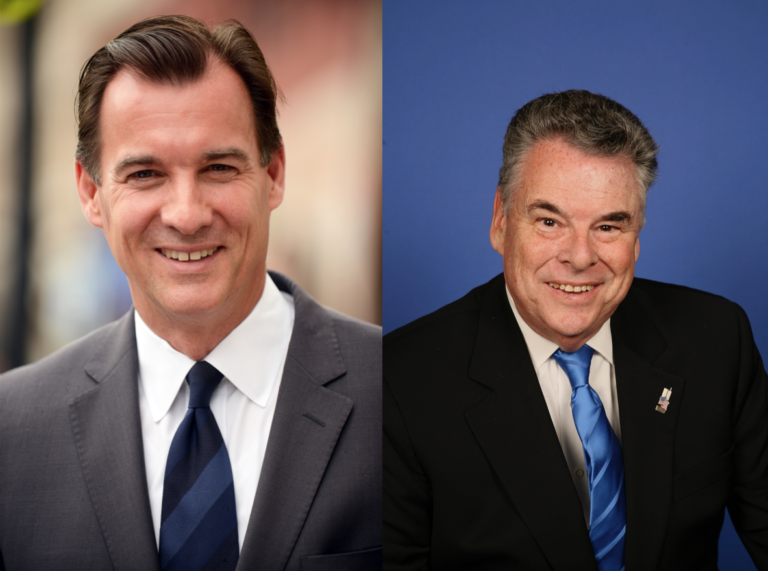

Reps. Tom Suozzi and Peter King wrote in a letter to the editor for Blank Slate Media that “ending or even tinkering with [tax] deductions would be bad for New York, bad for Long Island and bad for all of our constituents.”

The House tax plan would eliminate state and local tax deductions, or SALT, which have been in place since 1913. SALT allows taxpayers who itemize to deduct state and local taxes from their federal tax bill.

The proposed reform would hit Long Island residents hard since New Yorkers pay some of the highest taxes in the nation, the congressmen wrote.

The House version of the plan eliminates the state and local tax deduction, and caps property tax deductions at $10,000. The Senate version is “even more draconian,” Suozzi and King wrote, wiping out all state and local tax deductions entirely.

Additionally, the Senate plan will repeal the Affordable Care Act mandate that requires citizens without insurance to pay a penalty.

“We believe that any tax reform plan must include tax cuts for the struggling middle class,” the congressmen wrote. “The last time Congress came together to overhaul our tax code was 1986. Since then, the code has become voluminous and, in turn, more difficult for average Americans to comprehend.”

The proposed tax reform would be “a punch to the gut” for the hard-working Long Island families still recovering from the “economic meltdown” of the last decade, Suozzi and King wrote.

The GOP can lose a maximum of 22 House votes from its party to pass the bill. Along with King, three other Republican representatives from New York, Reps. Lee Zeldin, of eastern Long Island, Elise Stefanik and Dan Donovan, have stated that they will vote no. Three New Jersey House Republicans and two from California have also come out as a no, leaving the GOP with 13 votes to spare, according to Roll Call.

Local elected officials are taking a stand against the tax reform, too. Villages across the Town of North Hempstead, including Roslyn, East Hills and Great Neck Plaza, have also passed resolutions formally opposing eliminating SALT.

East Hills Mayor Michael Koblenz said in a previous interview that the tax reform would hit millions of New York families with a “one, two punch: higher taxes and lower home values.”

“Local governments such as us would be hit hard if Washington takes away the deduction,” Koblenz said. “We would face the consequences. Reducing local taxes to compensate.”

While GOP leaders who wrote the bill say it benefits the middle class, Suozzi and King wrote that is just not true for New York.

[…] 3. Congressman Tom Suozzi describes how New York subsidizes all of the other States. LinkSee also, Congressman Peter King’s push to retain State and Local tax deductions on Federal income taxes. Link and Link […]

[…] 3. Congressman Tom Suozzi describes how New York subsidizes all of the other States. Link See also, Congressman Peter King’s push to retain State and Local tax deductions on Federal income taxes. Link and Link […]