While the news media serves up heaping helpings of negative news, there’s something happening to our inflation story. It’s actually deflating.

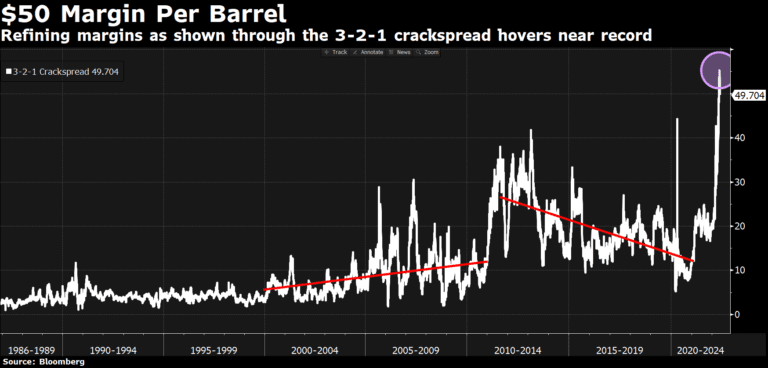

First, oil prices have slipped below $100 a barrel. But the price of oil wasn’t behind the spike in gasoline prices: refining costs are. The “crack spread,” that is, the price difference between the cost of a barrel of oil and the retail price of a gallon of gas, is usually around 30 cents a gallon. Recently, it’s been as high as $1.50 a gallon. The reason? Oil companies have been shutting down refineries for some time, and new ones are not being built because they reason demand will lessen over the coming years, and these facilities are built to last decades. No one wants to be left with a “stranded asset” that costs billions to build and little consumer demand to keep it running.

In the meantime, the gas price issue was always overbaked. Sure, people hate paying more, especially if the price spikes in a short time frame as opposed to over time, but the fact is it was more of a nuisance than an economic millstone for most people.

With employment still robust and consumers packing showrooms and airports, people’s actions aren’t matching what they tell pollsters. This holds for gasoline prices. The last time a price spike hit, there were lines out the door to buy economical compact cars while Cadillacs collected dust on showroom floors. That isn’t happening now, and it looks like consumers are accepting it as a mere inconvenience to endure.

What else is down? Wheat has retraced in price almost down to pre-Ukraine invasion levels. Corn and soy prices are weakening as well. So too have a slew of industrial metals like copper, which many use the price of as an economic barometer. All of these declines will put a dent in the CPI data in a couple of months when the fresh data is factored in.

But wait, there’s more! Lumber prices have cratered precipitously, which some homebuilders have expressed as a tailwind to their business and a solid offset against rising wages in the construction field.

What this means is the Fed may not have to tighten as much as originally thought and they may achieve the “soft landing,” which is the goal of every central banker after an economic run-up.

What to make of all this? Well, one of the smartest financial minds I know stated the following after someone pointed out last week that the price of oil had dropped 10% overnight despite their being no change in either inventory or demand:

“Can’t underscore this enough. The financialization of commodities made speculation the dominant driver in the short and often medium term. Doesn’t stop people from trying to extract fundamental interpretations from every move, but it’s typically about positioning and risk appetite.”

In other words, it’s the trading action that’s driving these wild price swings, and while supplies of gas and oil have certainly tightened globally, I’m sure you’ll all notice there is plenty of product out there and no one has waited on a line to tank up. There’s plenty for everyone.

Look for further deflation as traders close out their positions, leaving the bag holders behind.

Donald Davret

Roslyn