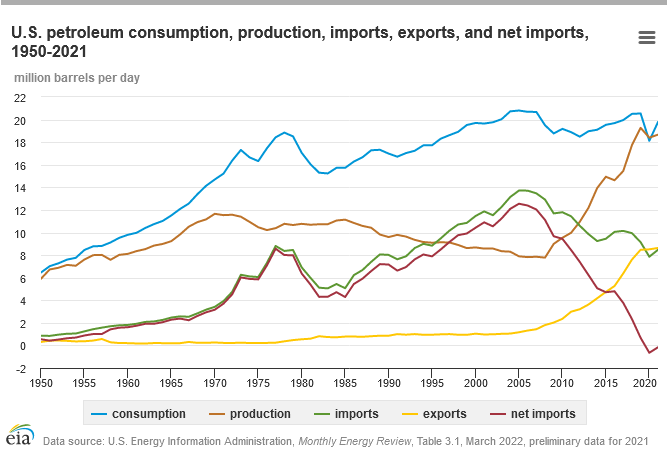

From 1950–70 consumption outpaced domestic production, increasing from 6-14+ million barrels of oil per day (MBOPD). Production peaked in the 1960s at 8MBOPD) and began to decline, the U.S. began importing oil.

Easily tapped reservoirs depleted faster than new sources were developed. Until then the U.S. was the largest producer and set the world price based on West Texas oil priced by the Texas Railroad Commission. Abundant domestic energy reserves and natural resources helped make the U.S. No. 1 economically, industrially, and militarily. It’s not easy being No. 1.

The Organization of the Petroleum Exporting Countries formed in 1960 and aggressively picked up the slack left by declining U.S. production.

By the 1970s U.S. imports reached 8MBOPD with OPEC providing 85%. OPEC’s oil embargo in 1977 occurred at critical time to cripple the U.S. economy and destroy its oil industry. OPEC’s manipulations to the detriment of the U.S. are well documented. Another major attempt occurred in the 1990s when OPEC led by a Saudi prince opened taps to create an oversupply that drove oil prices below breakeven for U.S. and European producers.

Oil is a dog eats dog competition.

OPEC started with Rockefeller’s Standard Oil Company as ARAMCO–the Arab American Company. Standard Oil was ARAMCO, as were successors, Chevron, Amoco, Exxon, Mobile, BP, until Saudi Arabia took control.

By 2008 the U.S. consumed about 19 million barrels of oil per day, and imported 13.7MBOPD (mostly not from OPEC).

Big production increases after 2008 were due to developing more problematic reservoirs and coincided with advances in technology: horizontal and directional drilling, 1–3M gallon fracks, one platform to drill multiple holes.

Costs increased. Onshore single wells that cost $1 million –$3 million went the way of the dinosaur as costs reached $10 million-$20 million per multiple-hole platform.

The economics worked because the price of oil increased. Fracking was utilized prior though to a lesser extent. When I worked in the business we fracked single hole wells with 100,000-150,000 gallons.

Around 2008 despite shortfalls in production petroleum was exported at increasing rates. Today the U.S. both uses and produces about 19.5. Importantly, U.S. companies export 8–9 million barrels of oil per day, and import 8–9 million barrels of oil per day. Despite the fact that the U.S. uses 19.5 million barrels of oil per day, imports about equal exports.

Hold the phone. Why not utilize all produced oil domestically, won’t it reduce prices? Oil is a commodity bought and sold on a global market subject to supply and demand. Companies are free to do business as they see fit and try to get the most by competing across the globe.

Petroleum was always a heavily manipulated economic and geo-political tool. Now the Kremlin jockeys, threatening European economies that depend on Russian oil and gas, supporting Ukraine conflicts with Kremlin policy. So far Russia cut gas to Ukraine, Poland, Bulgaria, Netherlands, Denmark, and Finland.

If Russia cuts gas to other countries those GDPs could fall 6%. Russia plays ping pong with Germany, which depends on Russia for 65% of its gas, 40% of its oil. North Europe receives 2/3 of the oil it had received. At the same time, Russia steeply discounts sales to other countries.

In 1977 the last major refinery came online, half have since closed. While upgrades have increased capacity ½ of refined petroleum is shipped overseas, mostly to Europe, a lucrative market, more so with Europe’s back against a wall.

Most oil once slated for the Keystone XL Pipeline was going to Gulf Coast refiners which typically export 2/3 of what they process, not domestic use, according to the U.S. Energy Information Agency. Companies decide where products go, but it’s simple math, either result was not enough to depress prices.

A large oversupply occurred when the 2020 pandemic hit, oil sold for -$38 barrel. Oversupply was quickly adjusted as producers reduced production to match demand to avoid oversupply.

One thing that would decrease prices is if supply were to exceed demand, depressing prices to make a sale. U.S. produces at capacity, and OPEC won’t substantially open taps to increase supply though could.

A CEO oil company friend says $200 barrel oil is possible, meaning $7-9 gallon gasoline. Or drop below $100 barrel in a recession. Now oil is $100 barrel, it was 6$ through the 60s.

Blaming presidents for oil prices is a false flag. Production since 2020 is up, roughly equaling consumption, however, half is exported. Production will decline if new sources are not developed, reserves are declining.

There’s about a 3 year lag to develop on-shore sources, 5 plus years for off-shore (leasing, geophysics, permitting, applications, drilling, getting petroleum into a pipeline, refining, distribution, marketing). Federal leases are pretty steady. Drilling, production and consumption, are wild cards, based on many conflicting factors.

Conversely, the world consumes 100 million barrels of oil per day,, if the world used less oil, OPEC’s and the Russia’s moves would be irrelevant. And if the U.S. developed reliable major alternate domestic energy sources. It’s not a theoretical question.

Petroleum is the most entrenched and lucrative industry the world has known, manipulation occurs at every turn, there’s phenomenal waste, fraud, pollution, it’s very heavily subsidized and other issues, topics for later.

Stephen Cipot

Garden City Park

The author worked 7 years as a geologist in oil, gas, and mining, at multiple locations in the U.S., including for the Fortune 500 multi-national company infamous for the Karen Silkwood “incident”, before completing a satisfying career with the USEPA, having successfully switched from wearing a black hat to a white one.